What is a DeFi Liquidity?

Introduction

In recent years, the world of decentralized finance (DeFi) has experienced remarkable growth, revolutionizing the traditional financial landscape. DeFi allows individuals to access financial services and products without the need for intermediaries like banks. One crucial element that powers DeFi protocols is liquidity. In this article, we will delve into the concept of DeFi liquidity, its importance, how it works, and its future implications.

Understanding DeFi Liquidity

DeFi liquidity refers to the availability of assets within a decentralized finance ecosystem that can be easily bought or sold without significantly impacting their market price. Liquidity is essential for the smooth functioning of financial markets, as it ensures that traders can execute transactions quickly and efficiently. In the context of DeFi, liquidity is provided by users who lock their assets into liquidity pools.

The Importance of Liquidity in DeFi

Be very cautious if someone tells you they can get your funds back from a scam. Sadly, funds recovery is often another type of fraud. Here are some legitimate platforms I've written about so far:

Liquidity is the lifeblood of any financial system, and the same holds true for DeFi. High liquidity in DeFi protocols attracts more users and allows for a more stable and secure platform. It encourages participation, as users can easily enter and exit positions. Additionally, liquidity is vital for enabling advanced financial products, such as decentralized exchanges (DEXs) and lending platforms.

How DeFi Liquidity Pools Work

DeFi liquidity is primarily facilitated through liquidity pools. These pools consist of smart contracts that hold funds contributed by users. Each pool is dedicated to a specific token pair, such as ETH/DAI. Liquidity providers deposit an equal value of each token into the pool. In return, they receive liquidity pool tokens representing their share of the total pool.

Benefits and Risks of DeFi Liquidity

Benefits

- Earning Passive Income: Liquidity providers earn rewards for supplying funds to the pool. These rewards often come in the form of trading fees or governance tokens.

- Flexibility: Users can add or withdraw liquidity at any time, giving them flexibility and control over their assets.

- Diversification: By participating in multiple liquidity pools, users can diversify their holdings and reduce risk.

Risks

Impermanent Loss: When the value of tokens in a liquidity pool diverges significantly, liquidity providers may experience impermanent loss when they withdraw their funds.

Smart Contract Vulnerabilities: As liquidity pools rely on smart contracts, they are susceptible to potential vulnerabilities and hacks.

Strategies for Maximizing DeFi Liquidity

To maximize returns and minimize risks, liquidity providers can employ various strategies, such as:

- Yield Farming: Engaging in yield farming by staking liquidity pool tokens to earn additional rewards.

- Arbitrage Trading: Taking advantage of price differences between different liquidity pools.

Popular DeFi Liquidity Platforms

Several DeFi protocols offer liquidity provision services, including:

- Uniswap: A decentralized exchange is known for its automated market-making (AMM) model.

- Balancer: An AMM platform that allows liquidity providers to set custom token weightings.

DeFi Liquidity Mining and Yield Farming

DeFi liquidity mining and yield farming are strategies used by protocols to incentivize liquidity providers. Users are rewarded with governance tokens or other rewards for providing liquidity to specific pools.

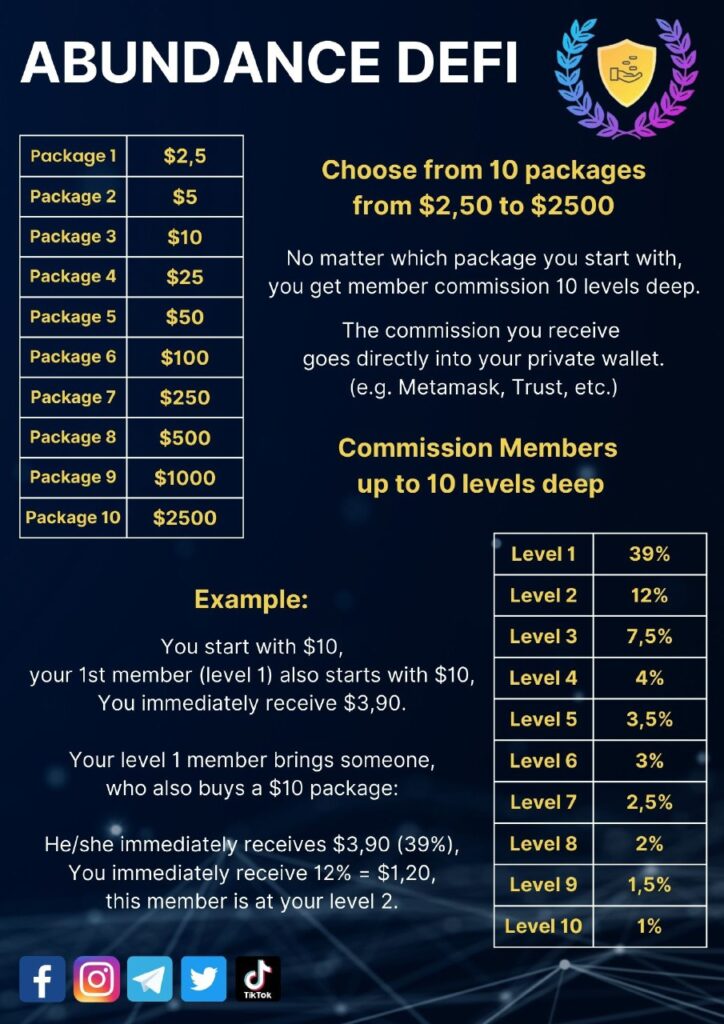

Check Abundance DeFi review

Challenges in DeFi Liquidity

Despite the many advantages of DeFi liquidity, it also faces challenges, such as:

- Impermanent Loss Mitigation: Developers are exploring ways to minimize impermanent loss for liquidity providers.

- Regulatory Uncertainty: DeFi protocols are still subject to evolving regulations, which could impact liquidity provision.

Future of DeFi Liquidity

The DeFi ecosystem is continually evolving, and liquidity will remain a crucial aspect. As DeFi matures, we can expect improved liquidity solutions and more robust protocols. Interoperability between different DeFi platforms may also lead to increased liquidity and efficiency.

Conclusion

DeFi liquidity plays a central role in enabling a decentralized financial system. It empowers users to trade, lend, and borrow assets without relying on traditional financial institutions. As the DeFi space continues to grow, liquidity will be a key factor determining the success of various protocols. However, users should remain cautious and informed about the risks associated with providing liquidity.

FAQs

1. What is impermanent loss in DeFi liquidity pools?

Impermanent loss occurs when the value of tokens in a liquidity pool changes, leading to a temporary loss for liquidity providers upon withdrawal.

2. How can I start providing liquidity in DeFi protocols?

To provide liquidity, you’ll need to visit a supported DeFi platform, connect your wallet, and deposit equal amounts of the token pair you want to add liquidity to.

3. Are there risks in yield farming?

Yes, yield farming involves risks such as smart contract vulnerabilities, impermanent loss, and potential market volatility.

4. What are the benefits of using decentralized exchanges (DEXs) for liquidity provision?

DEXs offer non-custodial trading, increased accessibility, and the ability to participate in various liquidity pools.

5. How can DeFi liquidity benefit the broader financial ecosystem?

DeFi liquidity provides individuals with more options for financial services, reduces reliance on centralized intermediaries, and fosters financial inclusivity.