Microfinance Institutions in Ghana: Empowering Financial Inclusion

Microfinance institutions (MFIs) have emerged as a crucial component of Ghana’s financial landscape, playing a vital role in promoting financial inclusion and empowering individuals and small businesses who lack access to traditional banking services.

What are Microfinance Institutions?

MFIs are financial service providers that offer small loans, savings products, and other financial services to low-income individuals and small businesses who are often excluded from the formal banking sector.

They typically operate in rural and underserved areas, providing much-needed access to credit and financial resources.

ALSO READ: Traditional Banking in Ghana: A Comprehensive Overview

Types of Microfinance Institutions in Ghana

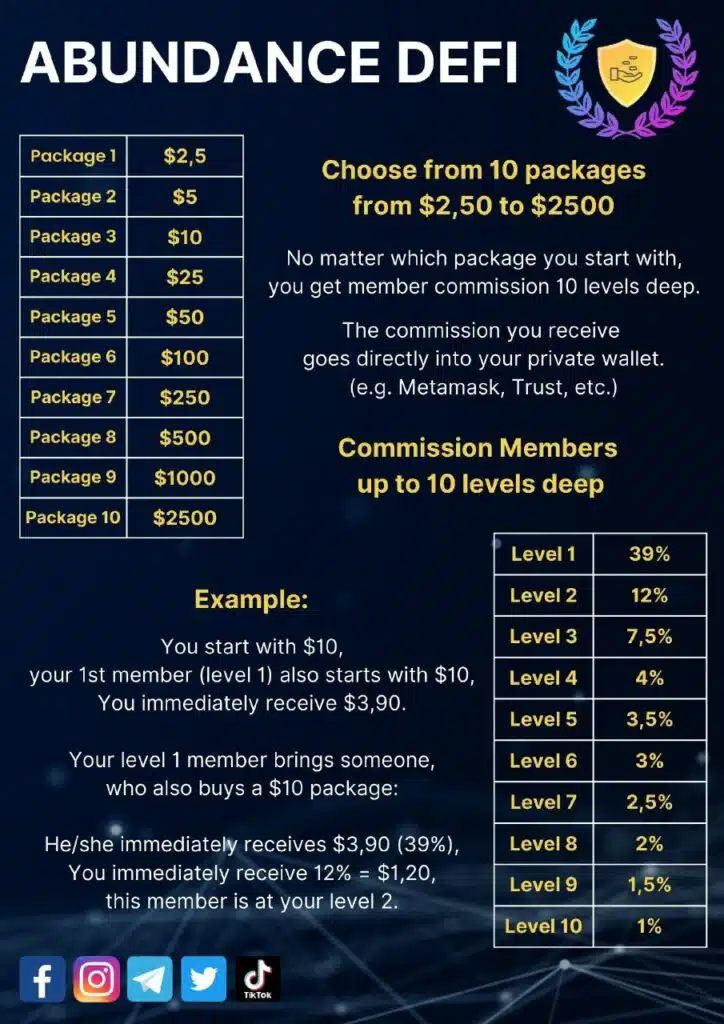

Be very cautious if someone tells you they can get your funds back from a scam. Sadly, funds recovery is often another type of fraud. Here are some legitimate platforms I've written about so far:

Ghana’s microfinance sector comprises various types of institutions, including:

- Deposit-taking Microfinance Institutions: These MFIs accept deposits from the public and offer savings products, loans, and other financial services.

- Non-Bank Financial Institutions: These include financial NGOs, credit unions, and other entities that provide microfinance services without being licensed as banks.

- Rural and Community Banks: These banks are specifically focused on providing financial services to rural communities and are often owned and operated by the communities they serve.

Impact of Microfinance in Ghana

Microfinance has had a significant impact on Ghana’s socio-economic development, including:

- Poverty Reduction: MFIs have helped reduce poverty by providing access to credit for income-generating activities, enabling individuals to start or expand their businesses, and improving their livelihoods.

- Women’s Empowerment: Many MFIs target women, recognizing their critical role in economic development. Access to microfinance has empowered women to become financially independent, improve their families’ well-being, and contribute to their communities.

- Rural Development: MFIs have played a crucial role in promoting rural development by extending financial services to remote areas, boosting agricultural productivity, and stimulating economic activity in rural communities.

List of Microfinance Institutions in Ghana

Here are some of the leading microfinance institutions in Ghana:

- Sinapi Aba Savings and Loans

- Opportunity International Savings and Loans

- Letshego Ghana Savings and Loans

- ASA Savings and Loans

- Advans Ghana Savings and Loans

- ABii National Savings and Loans

- Dalex Finance and Leasing Company Limited

- Izwe Savings and Loans PLC

Bond Savings and Loans PLC- MultiCredit Savings and Loans Limited

Challenges and Future Prospects

The microfinance sector in Ghana faces challenges such as limited access to capital, regulatory constraints, and competition from digital financial services.

However, the sector has enormous potential for growth, particularly with the increasing adoption of technology and innovative financial products.

Key Regulatory Bodies

The Bank of Ghana is the primary regulator of the microfinance sector, ensuring the safety and soundness of MFIs and protecting the interests of depositors.

Other key stakeholders include the Ghana Association of Microfinance Companies (GAMC) and the Association of Financial Non-Governmental Organizations (ASSFIN).

MFIs continue to play a pivotal role in Ghana’s journey towards financial inclusion, empowering individuals and communities to achieve their economic aspirations.