Fido Loan Review: Is It a Legitimate Lending Platform in Ghana?

In the ever-evolving landscape of financial technology, mobile lending apps like Fido Loan have gained popularity in Ghana, offering convenient access to personal loans.

However, with the rise of online scams, it’s crucial to assess the legitimacy of any lending platform before using it. This review delves into Fido Loan’s features, requirements, and potential risks to help you make an informed decision.

What is Fido Loan?

Fido Loan is a mobile lending platform operating in Ghana, allowing users to borrow and repay money through their mobile wallets.

The app aims to empower individuals and entrepreneurs by providing financial opportunities through accessible loans.

Fido Loan Requirements and Application Process

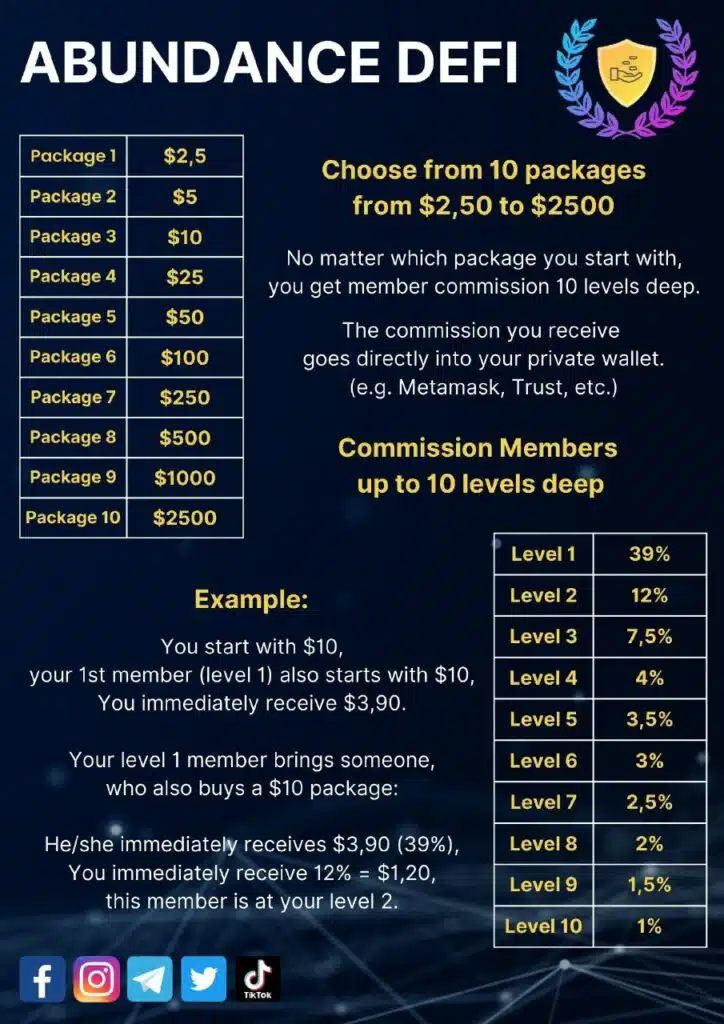

Be very cautious if someone tells you they can get your funds back from a scam. Sadly, funds recovery is often another type of fraud. Here are some legitimate platforms I've written about so far:

To qualify for a Fido Loan, you need:

- A valid ID (Driver’s License, NHIA Membership, Voter ID, National ID, or Passport)

- Ghanaian residency and be over 18 years old

- An active MTN Mobile Money or AirtelTigo Money account registered in your name for at least two months

Applying for a loan is simple

- Download the Fido app from Google Play or App Store.

- Create an account and fill in your personal information.

- Select your desired loan amount and terms.

- Get real-time approval and receive funds in your mobile wallet.

Fido Loan Review: Key Details and Concerns

- Loan Amount: GHC 100 – GHC 3,500

- Address: 8 Blohum Road, Dzorwulu, Accra

- Email: info@fidocredit.com / info@fido.money

- Phone/WhatsApp: 024 243 6885 / +233302764805 / +233596922420

- Website: https://www.fido.money/

While Fido Loan claims to be licensed by the Bank of Ghana, it’s essential to be cautious and verify its legitimacy.

Verifying the Legitimacy of Fido Loan

- Physical Address: Use Google Maps to confirm the address exists.

- Licenses and Registration: Verify their licensing status with the Bank of Ghana.

- Online Reviews: Read user reviews on third-party websites and social media.

- Terms and Conditions: Thoroughly review the terms to understand all fees and charges.

- Customer Support: Contact their customer service to ask questions and assess responsiveness.

- App Security: Ensure the app uses strong encryption and security protocols to protect your data.

Conclusion

Fido Loan offers a convenient way to access personal loans in Ghana. However, due diligence is crucial when using any online lending platform.

By carefully researching and verifying Fido Loan’s legitimacy, you can make an informed decision about whether it’s the right choice for your financial needs.

Additional Tips

- Compare Fido Loan with other reputable lending platforms in Ghana.

- Borrow responsibly and only what you can comfortably repay.

- Report any suspicious activity to the relevant authorities.

Remember, your financial security is paramount. Always prioritize thorough research and choose a lender you can trust.